How Do I Start Budgeting for Beginners?

If you’ve ever thought, “Budgeting is too complicated,” you’re not alone. Many people feel overwhelmed by spreadsheets, apps, and endless calculations. But the truth is, budgeting for beginners doesn’t have to be intimidating. The key is to start small and focus on three foundational steps:

Step 1: Track Your Income and Expenses

Before creating a budget, you need to understand where your money is going. Use a simple tool like a notebook, spreadsheet, or budgeting app to record:

- Monthly income (salary, side hustles, investments)

- Fixed expenses (rent, utilities, debt payments)

- Variable expenses (groceries, entertainment, dining out)

Step 2: Set Realistic Financial Priorities

Identify your non-negotiable expenses (like rent) and areas where you can cut back. For example, reducing takeout orders or subscription services can free up cash for savings.

Step 3: Choose a Budgeting Framework

Beginners often thrive with the 50/30/20 rule:

- 50% of income for needs

- 30% for wants

- 20% for savings or debt repayment

What’s the Simplest Budgeting Method?

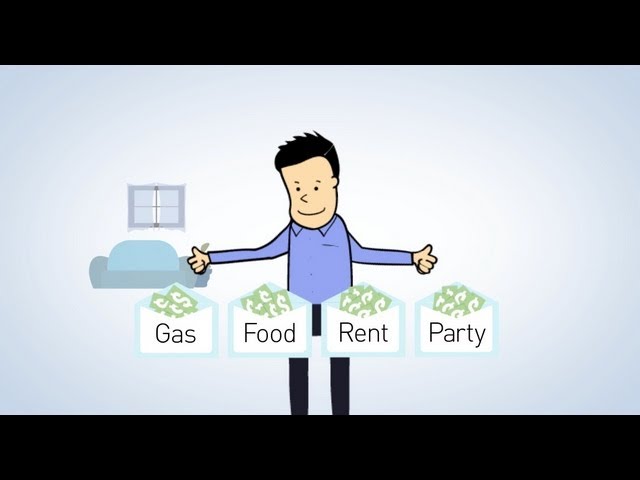

If traditional budgeting feels restrictive, try the Three-Bucket System. This method removes guesswork and adapts to your lifestyle effortlessly.

The Three-Bucket System Explained

- Bucket 1: Essentials (50-60% of income): Cover bills, groceries, and minimum debt payments.

- Bucket 2: Financial Goals (20-30%): Save for emergencies, retirement, or pay off debt faster.

- Bucket 3: Lifestyle Choices (10-20%): Spend guilt-free on hobbies, travel, or dining out.

This method works because it prioritizes automation. Set up automatic transfers to each “bucket” so you never overspend.

Can Budgeting Really Reduce Financial Stress?

Absolutely. A foolproof budget acts like a financial roadmap, eliminating surprises. For instance, knowing you’ve allocated $200 monthly for car maintenance prevents panic when repairs arise. Studies show that people who budget consistently report lower anxiety about money because they:

- Build emergency funds for unexpected costs

- Avoid credit card debt from overspending

- Gain clarity on their financial health

How Do I Stick to a Budget Without Feeling Restricted?

The secret is flexibility. Rigid budgets often fail because life is unpredictable. Instead:

Use the “Rollover” Technique

If you underspend in one category (e.g., groceries), let the remaining funds “roll over” to next month or reallocate them to another bucket.

Designate “Fun Money”

Assign a small portion of your income to discretionary spending. This allows you to enjoy life without derailing your goals.

Review and Adjust Monthly

Life changes—so should your budget. Adjust allocations for seasonal expenses (like holidays) or income fluctuations.

What Are Common Budgeting Mistakes to Avoid?

Even with a stress-free budgeting method, pitfalls exist. Here’s how to sidestep them:

Mistake 1: Underestimating Expenses

Always add a 10% buffer to irregular costs (e.g., medical bills, car repairs).

Mistake 2: Ignoring Small Purchases

Daily $5 coffees add up to $150/month. Track micro-expenses to identify leaks.

Mistake 3: Overcomplicating the Process

Avoid using six different apps or 30 spending categories. Simplicity ensures longevity.

How Often Should I Review My Budget?

Monthly reviews are ideal. Use this time to:

- Compare actual spending vs. planned amounts

- Celebrate progress toward goals

- Adjust for upcoming expenses (e.g., vacations, tax payments)

For irregular earners (freelancers, entrepreneurs), quarterly reviews help align budgets with income trends.

Is There a Budgeting Method That Adapts to Irregular Income?

Yes! The “Pay Yourself First” method is perfect for freelancers or gig workers. Here’s how it works:

Step 1: Calculate Baseline Expenses

Determine the minimum needed to cover essentials each month (e.g., $2,500).

Step 2: Prioritize Savings

When income arrives, immediately allocate funds to:

- Essentials

- Emergency savings

- Taxes (if self-employed)

Step 3: Distribute What’s Left

Use extra income for goals or discretionary spending. In low-earning months, dip into emergency funds instead of accruing debt.

Final Thoughts: Embracing a Stress-Free Financial Future

Budgeting doesn’t have to feel like a chore. By adopting a flexible, foolproof method, you’ll transform money management from a source of stress into a tool for empowerment. Whether you choose the Three-Bucket System, 50/30/20 rule, or a hybrid approach, consistency is key. Remember, the goal isn’t perfection—it’s progress. Start today, and watch your financial confidence grow.