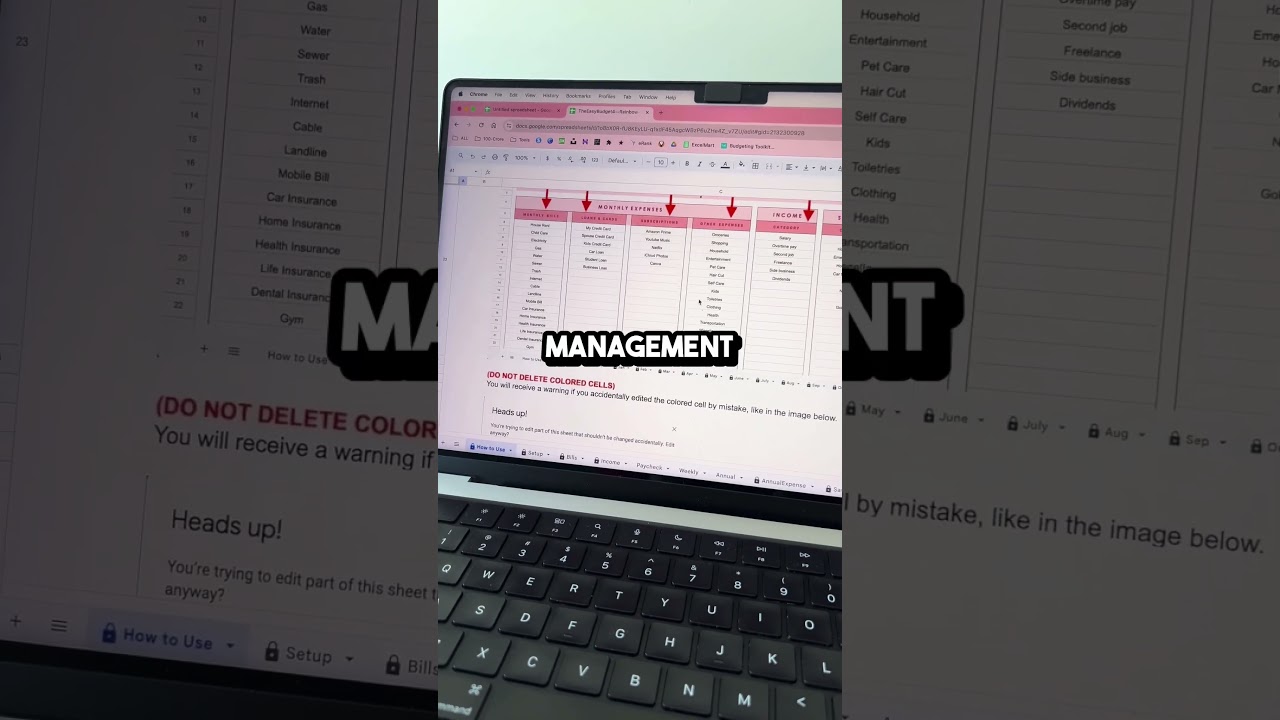

Budgeting Made Easy: Essential Tools to Stay on Track and Save Money

Introduction to Budgeting Made Easy Budgeting is one of the most essential skills for managing your finances effectively. Whether you’re trying to save money, pay off debt, or simply keep track of your spending, having a solid budget in place can make all the difference. However, many people find budgeting intimidating or time-consuming, which is