“`html

5 Simple Steps to Create a Budget That Saves You Money

Creating a budget that actually helps you save money doesn’t have to be complicated. By breaking it down into five manageable steps, you can take control of your finances and build a healthier financial future.

Step 1: Calculate Your Net Income

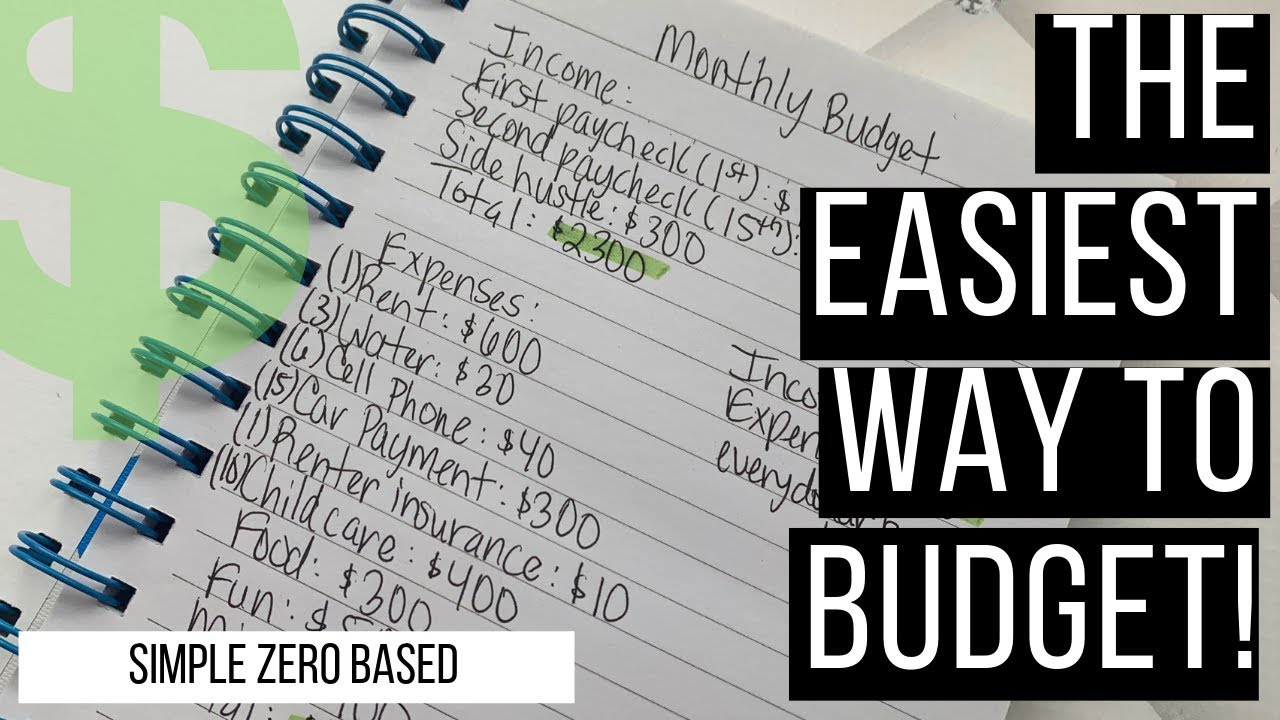

Net income is the amount of money you take home after taxes and deductions. Start by listing all sources of income, including salaries, freelance work, or side hustles. If your income varies, use an average of the last three months.

- Include consistent paychecks and irregular income streams.

- Subtract taxes, health insurance, and retirement contributions.

Step 2: Track and Categorize Your Expenses

Tracking expenses helps identify spending patterns. Use apps like Mint or a simple spreadsheet to log every purchase. Divide expenses into:

- Fixed expenses: Rent, utilities, loan payments.

- Variable expenses: Groceries, entertainment, dining out.

Step 3: Set Financial Goals

Define short-term goals (e.g., saving for a vacation) and long-term goals (e.g., retirement). Assign a dollar amount and deadline to each goal to stay motivated.

Step 4: Create Spending Limits

Based on your income and goals, allocate funds to each category. Ensure essentials are prioritized. For example:

- 50% to needs: Housing, groceries, transportation.

- 30% to wants: Hobbies, subscriptions.

- 20% to savings/debt repayment.

Step 5: Review and Adjust Monthly

Budgets are dynamic. Review monthly to see if you’re overspending in certain categories and adjust as needed. Celebrate small wins to stay motivated!

How Do I Start a Budget for Beginners?

Starting a budget can feel overwhelming, but simplicity is key. Follow these tips:

- Use a budgeting app: Tools like You Need a Budget (YNAB) automate tracking.

- Focus on one category at a time: Begin with groceries or entertainment.

- Aim for progress, not perfection: Even small savings add up.

What Is the 50/30/20 Rule and How Does It Work?

The 50/30/20 rule splits your income into three categories:

- 50% Needs: Essential expenses like rent and utilities.

- 30% Wants: Non-essentials like dining out or hobbies.

- 20% Savings/Debt: Emergency funds, retirement, or paying off credit cards.

This method ensures balance but can be adjusted. For example, if you’re tackling debt, allocate more to the 20% category.

Why Is Tracking Expenses Important in Budgeting?

Tracking expenses reveals where your money goes. Without it, you might overspend on hidden costs like subscriptions or impulse purchases. Benefits include:

- Identifying spending leaks.

- Making informed adjustments to stay on track.

- Building accountability and discipline.

How Can I Stick to My Budget and Avoid Overspending?

Sticking to a budget requires habit-building. Try these strategies:

- Use cash envelopes for discretionary spending.